What does MyCheck do?

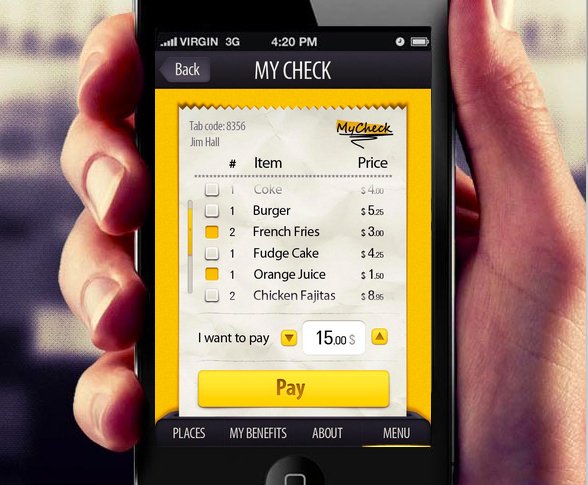

MyCheck, is a startup which is a revolutionary checkout technology which allows the users in restaurants to check, split and pay their bill in real time from their mobile device.

Their technology provides significant benefits to the merchants, which provides faster turnarounds, more tips for the servers and better targeted marketing to consumers. People love this technology as it makes them easy to split the bill, punch their loyalty cards which are built in and the users do not have to wait any more for the check or the credit card.

MyCheck’s technology appears in 3 ways- a standalone consumer app, which can be downloaded for free from Apple App Store and Google Play; a white label platform that is adopted by a lot restaurant chains; “MyCheck Inside” which has the capacity to power other consumer apps which are aimed at the hospital sector.

How much MyCheck was funded?

The startup has raised a $5 M in Series B funding on March 29th, 2015 from Santander Innoventures.

Previous Funding

- $200k in Angel round in 2011

- $1.7M in Seed round in January, 2012 from Werthaimer family

- $4.2M in Series A round inAugust, 2013 from Werthaimer family and Eli Elroy

What is next for MyCheck?

MyCheck is planning for expanding its business significantly. It is going to sell its service to plenty of restaurants and with more places MyCheck is useful, the future of the app is enhanced. MyCheck has its work cut out for it, and now it has the funding to do the work with proper vigor.

More about MyCheck

MyCheck, the checkout technology which allows the users to view, split and pay their bills from their phone through the MyCheck app. It was founded on March 7th, 2011 by Erez Spatz, Shlomit Kugler and Tal Zvi Nathanel.

MyCheck technology has been adopted by big clients like Isracard, Paypal in US, UK and others. This wide reach is possible with its integration with more than 25 restaurants point of sale systems for providing a great experience to the user and the merchant.

![[Jcount.com]](https://www.jcount.com/wp-content/uploads/2014/08/jcount150X50.png)

![[Jcount.com]](https://www.jcount.com/wp-content/uploads/2014/08/jcountstartupslogo1.png)